Get This Report on What Is Trade Credit Insurance

Wiki Article

The Single Strategy To Use For What Is Trade Credit Insurance

Table of ContentsThe Basic Principles Of What Is Trade Credit Insurance Getting The What Is Trade Credit Insurance To WorkThe Definitive Guide to What Is Trade Credit InsuranceIndicators on What Is Trade Credit Insurance You Should KnowHow What Is Trade Credit Insurance can Save You Time, Stress, and Money.

Trade credit report insurance coverage (TCI) repays companies when their customers are incapable to pay due to the fact that of insolvency or destabilizing political problems. Insurers usually price their plans based upon the dimension and also number of consumers covered under the policy, their creditworthiness, as well as the risk integral to the market in which they operate., which suggests the organization develops its own book fund specifically created to cover losses from unsettled accounts. The disadvantage to this strategy is that a firm might have to establish apart a substantial quantity of resources for loss prevention instead of utilizing that cash to expand the company.

A factor commonly purchases the right to those receivables at a significant discountusually 70% to 90% of the invoiced amount. The creditor may obtain a bigger percent if the factor handles to accumulate the complete financial debt, but it still has to pay a substantial charge for the element's services.

Essentially, it's an assurance from the acquiring company's bank that the vendor will be paid in full by a particular date. One of the downsides is that these can just be acquired as well as paid for by the customer, which might be unwilling to pay the purchase charge quantity for the financial institution's warranty.

More About What Is Trade Credit Insurance

That represents a compounded yearly development rate of 8. 6%.

Boost in sales and profits A credit rating insurance plan can usually counter its own cost many times over, also if the insurance holder never makes a claim, by boosting a company's sales and also earnings without added threat. Enhanced lender connection Trade credit score insurance coverage can boost a company's connection with their lender.

With profession credit scores insurance policy, you can dependably handle the business and political dangers of profession that are beyond your control. Trade debt insurance policy can aid you feel safe and secure in extending a lot click to investigate more debt to existing consumers or seeking brand-new, larger customers that would certainly have or else appeared as well risky. There are 4 sorts of trade credit report insurance, as described below.

The 5-Minute Rule for What Is Trade Credit Insurance

Whole Turnover This kind of trade credit scores insurance coverage secures against non-payment of business debt from all clients. You can select if this coverage puts on all residential sales, global sales or both. Secret Accounts With this kind of insurance policy, you choose to guarantee your biggest customers whose non-payment would position the best danger to your business.Transactional This kind of profession credit history insurance policy protects against non-payment on a transaction-by-transaction basis and also is ideal for firms with few sales or just one client. Trade debt insurance coverage only covers business-to-business accounts receivable from business and political threats. Impressive financial debts are not covered unless there is straight profession between your business and also a client (one more company).

It is generally not one of the most reliable option, since rather than investing excess funding into development opportunities, an organization should place it on hold in case of uncollectable bill. A letter of credit score is an additional option, however it only supplies financial debt security for one customer and also just covers global profession.

The factor provides a cash money development varying from 70% to 90% of the invoice's worth. Some factoring services will presume the risk of non-payment of the invoices they acquire, while others do not.

The Buzz on What Is Trade Credit Insurance

While receivables factoring can be valuable in the temporary, you will have to pay fees ranging from 1% to 5% for the solution, even if the receivable is paid in complete within 60-90 days. The longer the receivable continues to be unsettled, the greater the charges. Repayment warranties aren't constantly available, and also if they are, they can increase factoring charges to as high as 10%.The bank or element will offer the funding and the credit score insurance coverage will shield the invoices. In this case, when a funded billing goes unpaid, the case repayment will certainly go to the funder.

Credit scores insurance coverage protects your cash money circulation. Trade credit click to investigate score insurance functions by guaranteeing you versus your customer stopping working to pay, so every invoice with that customer is covered for the insurance coverage year.

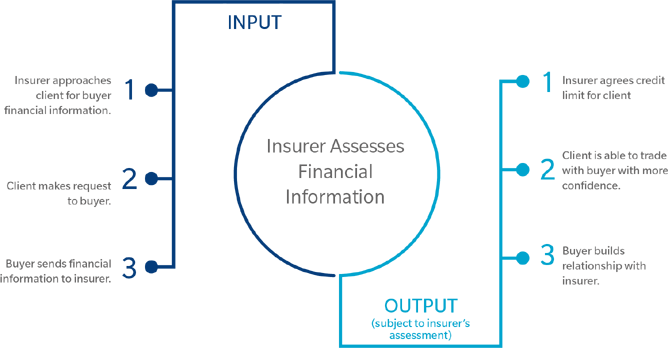

At Atradius Australia, we operate a Modula Credit report Insurance Coverage Plan. Atradius Credit scores Insurance policy explained: Your credit scores insurance provider ought to keep an eye on the financial health of your clients as well as possible customers as well as apply a risk rating, usually called a buyer score.

What Is Trade Credit Insurance Things To Know Before You Buy

It will certainly assist just how much of your exposure they are prepared to guarantee. The buyer rating is also a beneficial device for you. You can use it as an overview to support your own due persistance and aid you prevent possibly these details risky clients. A strong customer score can likewise help you protect possible customers by using them good credit score terms.Report this wiki page